Reviewing Credit

Let’s review the primary, secondary and tertiary objectives of your initial inbound call form a prospect in consumer direct lending… pull credit! We talk about putting equity to use, changing terms, and credit scores but the best tool to gain an accurate picture of a caller’s overall financial picture and in turn to better serve them, is to review credit with them.

Why We Pull Credit?

80% of Americans hold some form of debt – whether mortgages, car loans, unpaid credit card balances, medical and legal bills, student loans or likely a combination of those. Nine out of 10 Gen Xers and Millennials hold debt. At the same time, most American have just $5,000 in emergency savings. And to bring this home, the average home value grew by an amazing 10% since the onset of the pandemic. This is why you need to assume customers have debt, little savings and solid equity in their home. We must pull credit to validate the caller’s current situation and only then, we can motivate callers to get a better future state.

Why Loan Officers Shy Away from Asking to Pull Credit

Why don’t all bankers ask to pull credit? Well callers might say they….

1. Have terrible credit

2. Were recently turned down for a loan

3. Just took cash out

4. Have no need for home improvements

5. Have no stated debt outside of mortgage

6. Have a rate that’s better than what we could offer

7. Blah blah blah…

It does not matter what the caller tells us. The only thing that matters is what their credit report says. Do not prejudge the caller based on what they say. It takes 6 seconds to say, “we should review your credit together to be certain. May I have your date of birth? And your social?” This is how we get an accurate snapshot of the caller’s financial picture.

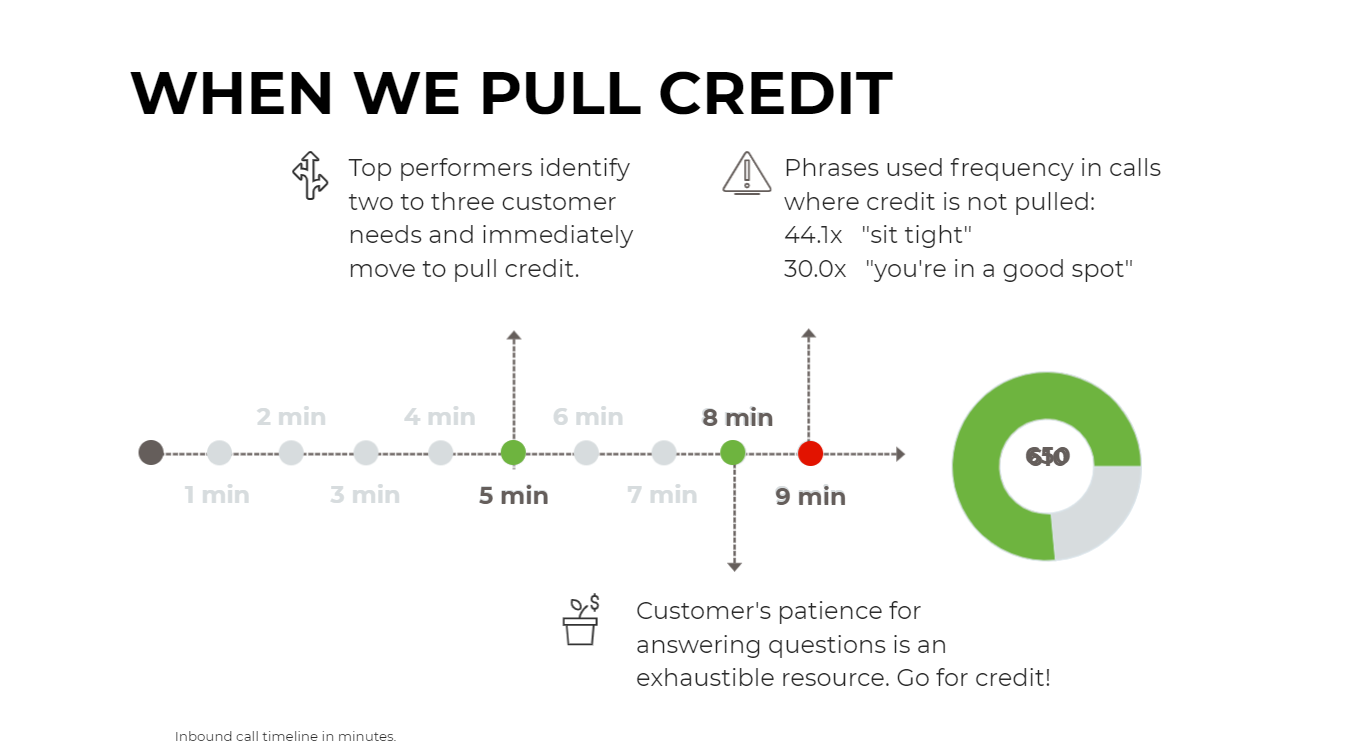

When to Pull Credit

Pulling credit is the pivotal moment of every call. Top performers identify two or three customer needs and immediately move to pull credit. This can be obtained within 5 minutes of the call and not more than 8 minutes. Callers’ patience are an exhaustible resource, so regardless of where you with your conversation, consider moving to pull credit at the 8 minute mark. especially callers are answering your questions and you are putting off their questions. No one has closed a loan without puling credit. Slim to no callers ask you to pull their credit. Meet your objective of asking to review credit.